Cash Conversion Cycle Calculator

Manage your working capital more efficiently

Cash Conversion Cycle

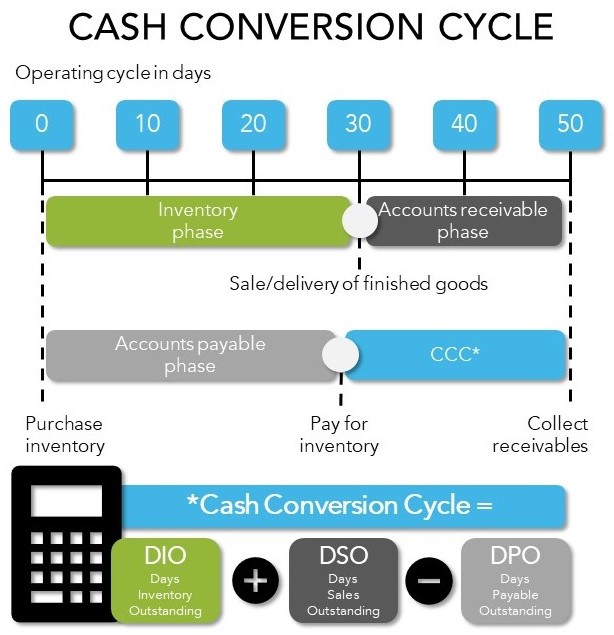

The Cash Conversion Cycle (“CCC”) is an indicator that provides information on how efficiently a company manages its liquidity . The cash conversion cycle indicates the time (measured in days) it takes for a company to convert its investments into free liquidity (“cash”) through sales.

This is how the CCC is calculated:

Cash Conversion Cycle = Days Sales Outstanding + Days Inventory Outstanding – Days Payables Outstanding

The CCC is a very good indicator of the liquidity that is tied up in the value chain. It is particularly meaningful if it is calculated regularly and compared with previous periods. It is also a good measure for identifying and monitoring opportunities for improvement.

There is no guide value for the CCC. However, it can be stated: The lower the CCC, the more efficiently a company manages its working capital. Even a negative CCC is possible. In any case, the CCC is an important comparative indicator within an industry, showing three parameters for possible improvement potential. The goal of professional liquidity management is to have as much circulating capital and as little fixed capital as possible. We would like to show you which options you have to improve your CCC!

Cash Conversion Cycle Calculator

WORKING CAPITAL OPTIMIZATION

Instruments for improving these parameters should accompany companies along the entire value chain. This is because only the combination of as many tools as possible ensures efficient 360° working capital management from risk management to liquidity provision for all those involved in value chain, regardless of company size, currency and liquidity situation.

OUR INSTRUMENTS TO IMPROVE YOUR CCC

Digital Receivables Purchasing

Release additional funds that would otherwise be blocked in receivables.

Read moreDynamic Discounting

Earn an attractive and risk-free return by investing excess liquidity in your supply chain.

Read moreReverse Factoring

Extend payment terms and improve your Working Capital with liquidity provided by financing partners.

Read moreAny questions?

- Sibel Kücükcolak

- Sales Executive

- +49 69 597 721 535