Dynamic

Supplier

Financing

SUPPLIER EARLY PAYER PROGRAMMES RETHOUGHT

Dynamic Supplier Financing is Traxpay’s reinvention of traditional Dynamic Discounting (early payment from own liquidity) and Reverse Factoring (early payment from external liquidity).

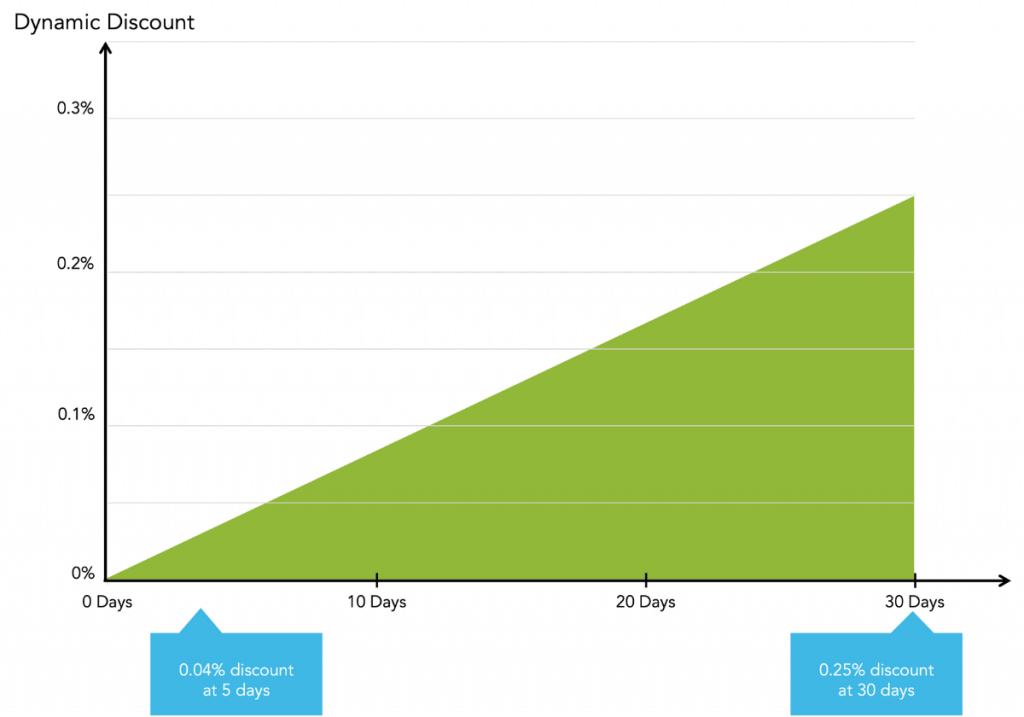

Unlike other offerings, corporates are able to seamlessly switch between using their own funds, or borrowing from a third party, to pay supplier invoices early in return for a discount. The buyer can determine the amount of the supplier discount themselves, regardless of the source of financing. The discount amount is calculated dynamically depending on the time of early payment. This dynamic approach is more efficient than a static discount, where it must be assumed that the discount will always be taken by the buyer if possible and is therefore priced into the conditions by the supplier in advance. As a buyer, you can therefore optimise your net terms.

Dynamic Supplier Financing can even be combined with Post Maturity Financing, enabling a treasurer to simultaneously extend Days Payable Outstanding and increase EBITDA. Combining the solutions on the Traxpay platform is an option – all solutions can of course also be used selectively and separately.

THE THREE MOST IMPORTANT ADVANTAGES FOR BUYERS:

Adaptable

Elect to use Dynamic Discounting or Reverse Factoring, and combine with Post Maturity Finance, depending on liquidity needs at the time.

Ease of set up

Programs using third party funding are far easier and quicker to establish than traditional reverse factoring arrangements. The use of standard digital negotiable instruments provides access to a wider range of potential financers.

Consistent, transparent discount pricing

Whether using own- or third-party funds, the buyer can ensure that the discount enjoyed by the supplier is consistent.

THE THREE MOST IMPORTANT ADVANTAGES FOR SUPPLIERS:

Simple to use

Suppliers log on to the platform via their web browser and immediately receive an overview of all invoices accepted by the buyer. With a simple click, early payment can be triggered – done.

Flexible

Only the invoice amounts that are actually needed to secure liquidity need to be accelerated. There is no obligation to accelerate all receivables – although this can of course be set up easily and quickly.

A more stable business relationship

With Dynamic Supplier Financing, suppliers receive their money earlier and reduce the customer’s payment risk. This reduces the cost of credit default insurance. Dynamic Supplier Financing stabilizes the liquidity supply and at the same time strengthens the relationship with the customer.

THE THREE MOST IMPORTANT ADVANTAGES FOR BUYERS:

Adaptable

Elect to use Dynamic Discounting or Reverse Factoring, and combine with Post Maturity Finance, depending on liquidity needs at the time.

Ease of set up

Programs using third party funding are far easier and quicker to establish than traditional reverse factoring arrangements. The use of standard digital negotiable instruments provides access to a wider range of potential financers.

Consistent, transparent discount pricing

Whether using own- or third-party funds, the buyer can ensure that the discount enjoyed by the supplier is consistent.

THE THREE MOST IMPORTANT ADVANTAGES FOR SUPPLIERS:

Simple to use

Suppliers log on to the platform via their web browser and immediately receive an overview of all invoices accepted by the buyer. With a simple click, early payment can be triggered – done.

Flexible

Only the invoice amounts that are actually needed to secure liquidity need to be accelerated. There is no obligation to accelerate all receivables – although this can of course be set up easily and quickly.

A more stable business relationship

With Dynamic Supplier Financing, suppliers receive their money earlier and reduce the customer’s payment risk. This reduces the cost of credit default insurance. Dynamic Supplier Financing stabilizes the liquidity supply and at the same time strengthens the relationship with the customer.

NUMBERS SPEAK LOUDER THAN 1,000 WORDS

Calculate the specific improvement potential for your company right here. Simple, fast and no obligation. You only need a few figures from your financial report. Your data is not stored by Traxpay and is subject to the German General Data Protection Regulation (GDPR).

Any questions?

- Sibel Kücükcolak

- Sales Director

- +49 69 597 721 535

Read also

Digital Guarantees

Use a flexible, secure and cost-effective alternative to trade credit insurance.

Read moreDigital Receivables Sales

Gain additional liquidity and reduce payment risks by selling receivables.

Read more