The term trade finance refers to techniques and instruments that facilitate (international) trade transactions and protect both buyers and suppliers from trade-related risks. The purpose of trade finance is to facilitate business transactions between companies. The purpose of trade finance is to facilitate business transactions between companies.

What exactly is trade finance?

In a trade transaction, the buyer and seller take on different risks. First and foremost is the risk of payment. In addition, there is the risk that the purchased goods will not arrive on time or that the expected quality or quantity will not meet the delivery contract.

These risks are exacerbated in international trade transactions, as settling disputes can be time-consuming and difficult – especially if the markets involved have different legal frameworks.

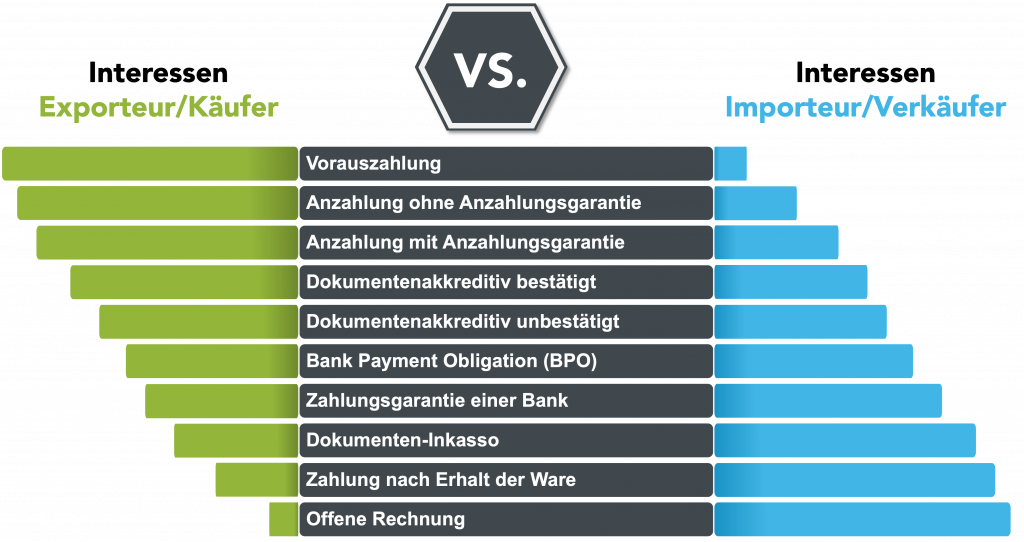

To mitigate these risks, there are various payment modalities that can be specified in a supply contract. The following overview shows the different payment modalities and the associated advantages and disadvantages for buyers and sellers.

The main terms of payment are briefly explained below:

Open Account

The most advantageous payment term for the buyer/importer is open account payment, especially if a deferred payment term is also granted by the seller. This is because the buyer (importer) pays for the goods only after they have been received. This protects the buyer from the risk of paying for goods that do not meet the required standards, but not the seller (exporter). Therefore, this payment term is only recommended for trustworthy or low-risk trade relationships.

The payment risk underlying this payment term can be reduced or even completely eliminated with so-called supply chain finance (SCF) instruments. SCF is a subcategory of trade finance. One option that only reduces payment risk but does not generate liquidity is to utilize (export) credit insurance.

Prepayment

At the other end of the spectrum, the exact opposite of the open account term is the advance payment (or prepayment). Here the buyer pays the supplier in advance, before the goods have been received. While this payment term protects the supplier from the risk of non-payment, it does not protect the buyer from the risk that the goods will not arrive on time and as expected, or at all.

Documentary Collection

The purpose of documentary collection is to protect the seller against the buyer’s payment risk. . This is because the buyer only receives the goods if he pays for them against delivery of all agreed documents (e.g. invoice, packing list, certificate of origin, transport document, etc.) or undertakes to make payment at a certain due date in the future. However, this instrument does not protect the seller against the buyer refusing to accept the goods. Especially in the case of perishable goods or goods/services specially made for the buyer, this is a risk that cannot be neglected.

Letters of credit

In contrast to documentary collection, a letter of credit not only covers the payment risk but also the risk of acceptance of the goods. This is because the beneficiary of a documentary credit, the seller, receives a claim for payment against presentation of documents that meet the conditions specified in the documentary credit. Neither the collection nor the letter of credit is subject to special laws. However, the uniform guidelines drawn up by the International Chamber of Commerce are applied.

With a letter of credit, the buyer’s bank issues a letter guaranteeing full and timely payment to the seller, provided the conditions stated in the letter of credit are met. The required documents usually include invoices, packing lists and transport documents. However, other documents may be required. If the buyer is unable to make the payment, the bank takes over the payment on behalf of the buyer.

In this way, inherent risks in commercial transactions are mitigated for both the buyer and the seller. The seller receives a guarantee that he will receive payment as long as he presents documents that are in accordance with terms and conditions stipulated in the letter of credit, while the shipping risk and, if applicable, the quality risk for the buyer are reduced or eliminated. When using a letter of credit, however, it must be taken into account that additional costs are incurred, credit lines are needed and additional administrative work (e.g. preparation and procurement of documents) is involved.

There are many different forms of letters of credit. The most common are:

- Irrevocable letter of credit: Theoretically, letters of credit can be revocable or irrevocable. Revocability means that the issuing bank can withdraw the letter of credit at any time. However, letters of credit of this type are rarely accepted, so a letter of credit is usually opened irrevocably according to ICC rules.

- Bestätigtes Akkreditiv: Neben der das Akkreditiv eröffnenden Bank (Akkreditivbank) garantiert auch die bestätigte Bank (meist die Bank des Begünstigsten/Exporteurs) die Zahlung aus dem Akkreditiv. Dies bietet zusätzliche Sicherheit für den Verkäufer mit folgenden Vorteilen:

- additional, independent payment obligation of the advising/confirming bank towards the beneficiary

- exclusion of the bank and country risk of the issuing bank

- Sight letter of credit: payment is due when the documents are presented.

- Deferred payment letter of credit: The Issuing Bank will pay within a certain period after the documents have been submitted, e.g. 90 or 180 days.

- Revolving letter of credit: The letter of credit shall be renewed by the amount utilised upon utilisation or upon expiry of a certain time period.

- Transferable letter of credit: This allows the first beneficiary as intermediary to transfer the letter of credit to a second beneficiary.

- Back-to-Back Akkreditiv: It is often used in trading transactions where the final buyer is to be kept in the dark about the origin of the goods and/or the conditions of the initial purchase. Based on the letter of credit opened by the final buyer, the bank of the intermediary trader opens an independent counter letter of credit in favour of the manufacturer/supplier.