HIGHLIGHT OF THE EVENTS: SUPPLY CHAIN FINANCE GOES GREEN! WITH TRAXPAY, ADVA, NORD/LB, ECOVADIS

Green financing continues to be a trend, and even companies that are not (yet) active in this market can no longer avoid the topic of ESG. Regulators, banks, investors, and their own employees are making sure of that. The need for information is therefore immense. The impact is greatest in the supply chain.

Sustainability is also moving into supply chains. Companies that rely on sustainable supply chain finance can expect more stable supply chains and even cost savings, and better financing conditions for suppliers. But there are still very few good practice examples. The Traxpay highlight of the Green FINANCE on March 22 was the workshop “Supply Chain Finance goes green”, in which the implementation of an SSCF program was assessed on a platform with first impressions from the field.

The workshop was moderated by Jakob Eich, editor at FINANCE. It was hosted by Kate Pohl, Head of Banking and Corporate Sales at Traxpay. Panellists assessed the topic from the perspectives of sustainability, treasury and the bank:

Sustainability expert Tanja Reilly, Business Development Manager DACH, EcoVadis, Treasurer Steven Williams, Director Treasury & Investor Relations, ADVA, and Jens Döring, Working Capital Financing Specialist, NORD/LB described their practical experiences.

For Steven Williams, the advantages of an SSCF program are obvious: As treasurer, he can use the excess liquidity, avoid negative interest rates, stabilize suppliers and make a positive contribution to the profitability of the SDAX-listed company. But: His biggest criterion for selecting the right platform was that a holistic supply chain financing solution should include not only dynamic discounting (where the company’s own liquidity is used) but also reverse factoring (where a bank takes over the financing). Especially here, but also in the joint onboarding of suppliers, the Traxpay platform, which is open to banks, was able to score with its strengths.

“Traxpay impresses with its flexibility, especially when objectives change. The question of whether to use own liquidity or external liquidity is an elementary factor in the selection of the platform,” says Jens Döring. “As a long-term partner, we at NORD/LB stand for financing security, accelerate the digitalization of processes, and increase transparency.”

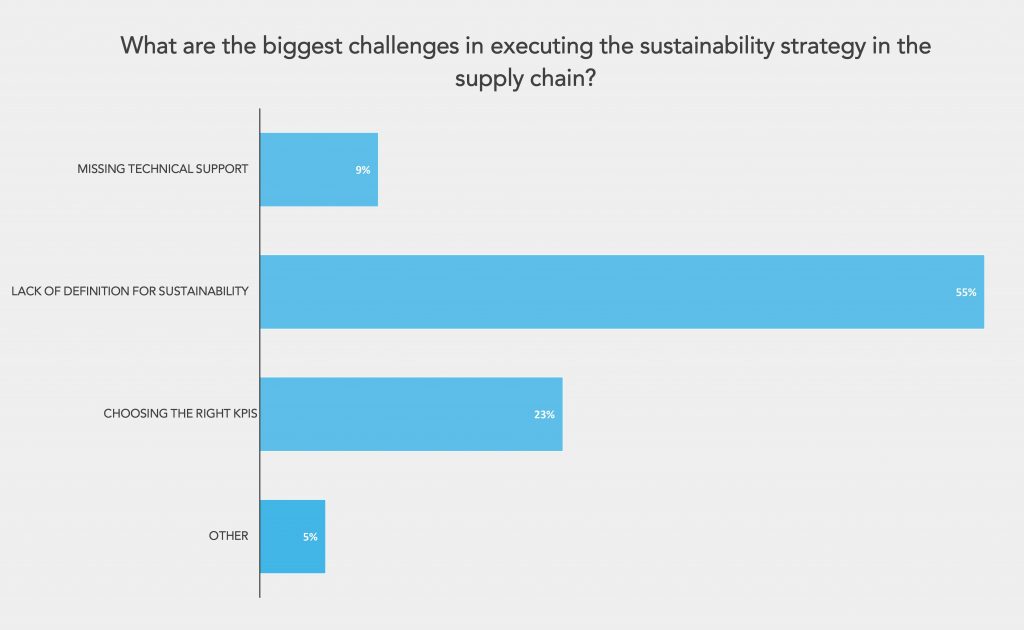

The spontaneous live audience survey also produced exciting results:

“Sustainability is very broad. There are striking differences depending on the industry environment. It is important to clarify this internally and, above all, across departments. We have to get out of silo thinking,” Tanja Reilly commented on the results.

Another exciting program highlight at Green FINANCE was the panel discussion “The run on ESG data: Challenge for the finance department”.

Investors, banks and even the company’s own employees want more and more information around a company’s sustainability performance. An additional driver is the regulator, which is demanding significantly more transparency. For finance departments, this is both a challenge and an opportunity. In this round, the results of the current Green Finance study by LBBW and FINANCE were discussed. The study results show that sustainability and green finance continue to be priorities in companies: In the study, 94% of the corporate decision-makers surveyed stated that sustainable corporate governance is (very) important to them – ESG is thus an integral part of corporate governance and the importance of sustainability will continue to grow strongly. 70% of the financial decision-makers surveyed have taken a closer look at sustainable financing, and there is significant growth in this area. Companies are not only developing sustainability out of self-interest, but stakeholders are also asking for sustainability.

Reliable data is needed to satisfy the need for information: A good half of the financial decision-makers surveyed confirmed that sustainability indicators are systematically collected within the company. 83% also state that it is very difficult to generate this data transparency.

The challenges in doing so are confirmed by Traxpay’s live survey:

Uniform standards

– Comparability

– Define key figures

– Reporting format

– Obtain proof for key figures

– Higher costs compared to international competitors

– Inclusion of supply chains

– Measurability

– Repeatable database

– Regular reporting

– Supply chain inclusion

– A majority of companies have long had an intrinsic motivation to address ESG.