There is no doubt that the future of Supply Chain Finance (SCF) will be characterized by a platform approach. How must banks position themselves to meet the challenges of “platformization”? In a digital talk, Traxpay and Aite-Novarica looked at the different SCF solutions in the market.

“Working with bank-friendly SCF platforms gives banks a great opportunity to offer automated and fully digital products to a new group of customers: namely, the suppliers of their corporate customers, often small or medium-sized enterprises (SMEs),” explains Kate Pohl, Head of Banking and Partner Strategy & Execution at Traxpay, who moderated the digital event. “This is an opportunity to offer products and services to a large network of additional business partners. Thus, SCF offers growth potential in unprecedented dimensions.”

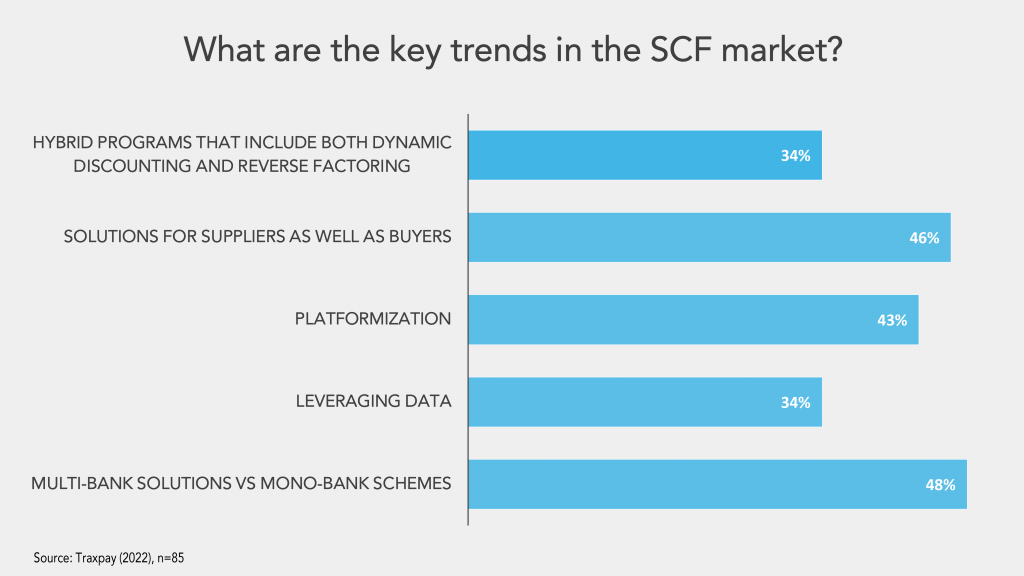

Enrico Camerinelli, Strategic Advisor at Aite-Novarica Group, pointed out that proactive banks must look at how to overcome the inevitable reality that corporate users increasingly want independence and freedom of choice. “Enterprises are no longer satisfied to be locked into mono-bank platform solutions. Banks should be equally aware that their large corporate clients want to work with platforms that offer easy, efficient, digital, and indeed rich solutions with a variety of features and functions. The primary goal of SCF remains the securing of liquidity“, the analyst explains, emphasizing that innovative platforms shape cloud-based ecosystems of “best-of-breed” products with flexible partners. These services extend the capabilities of “established” SCF platforms and enable Treasury and Finance teams to optimally manage their Working Capital.

Enterprises are rejecting mono-bank SCF programs, choosing instead flexible multi-bank platform solutions. But not all scheme providers are following the same strategy. Some of the incumbent SCF platforms are disintermediating banks, who, over time, lose client intimacy. Financial institutions need to act now and play an active role in determining which of the platform(s) should prevail in the market. “By channeling their business to Traxpay, a multi-bank, yet bank-friendly solution, financial institutions can support a new market standard. Traxpay’s platform offers key products like Dynamic Discounting, Reverse Factoring and Digital Forfaiting to its customers, i.e., corporate buyers and their suppliers. This will, in turn, support strong relationships between a bank and its clients in the SCF area and beyond,” explains Markus Rupprecht, CEO of Traxpay.

Bank-friendly platforms such as Traxpay make it possible for banks to extend their offerings in Working Capital Management and Supply Chain Financing with an innovative platform solution. In this way, products are offered and combined in a completely new manner, as complementary solutions to SCF programs. For example, Traxpay can integrate traditional banking services such as guarantees, virtual credit cards or foreign exchange onto the platform, providing a digital and seamless experience for both the corporate buyer and the supplier. The Digital Talk showed that collaboration between fintechs and banks – and the resulting synergies – create significant benefits for companies. In the future, enterprises of all sizes can take advantage of innovative products covering the entire SCF lifecycle.