Due to the effects of “black swan events” (pandemic, climate change, energy shortages), securing sufficient liquidity has become a high priority for corporate treasury departments. When focusing on securing liquidity, in addition to the question of “how”, the first question that arises is the origin of liquidity.

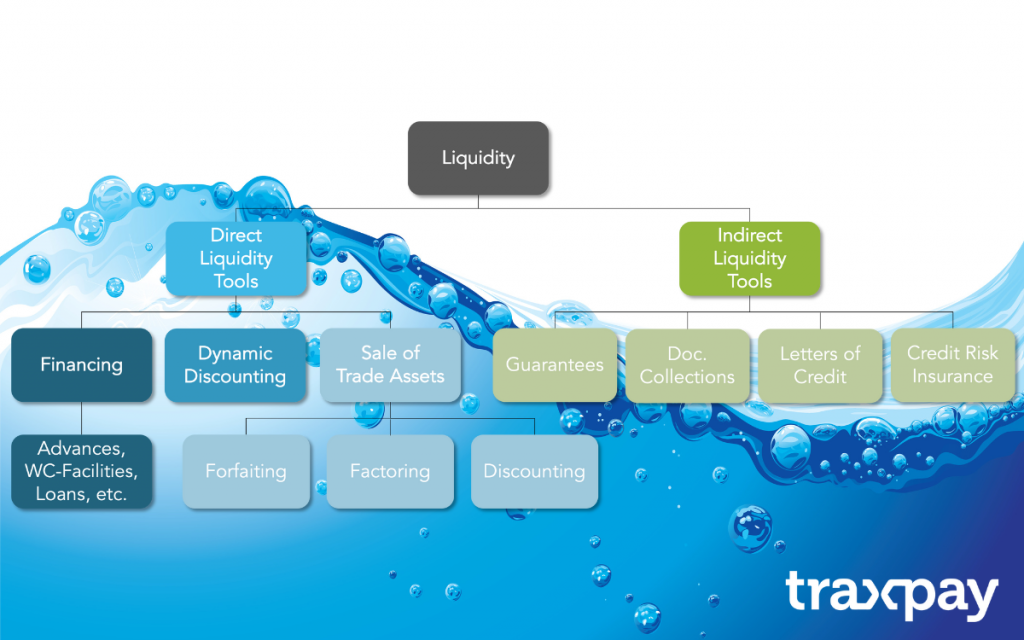

The following overview shows a rough distinction between indirect and direct sources of liquidity. The latter include equity capital and borrowed capital in the form of various forms of financing. These include loans, working capital credit lines, down payments and all money and capital market instruments such as bonds.

The possibility of receiving early payment from the buyer (Dynamic Discounting) and the sale of receivables are also direct sources of liquidity. There are three main techniques for selling receivables:

• Forfaiting

• Factoring

• Receivables Discounting

Asset Backed Securitisation (ABS) structures based on (trade) receivables are also used. In factoring and forfaiting, the focus is not only on releasing the working capital tied up in invoices, but also on eliminating the payment risk of the debtor. This is ensured by the non-recourse character of the sale of receivables. The buyer of the receivables primarily considers the payment or delcredere risk of the debtor. The purchase can be silent (without disclosure to the debtor) or open (with disclosure). In addition, the servicer risk of the seller of the receivable is assessed, especially if the purchase is made on an undisclosed basis. The servicer risk is primarily the ability/willingness of the receivables seller to sell receivables free of encumbrances and defences. It also examines whether the receivables seller can pass on payments it receives from the receivables debtors to the buyer of receivables on time. Finally, the risk of fraud (double assignments, sale of non-existent receivables) is subsumed under this.

Receivables discounting, on the other hand, involves the sale of receivables with recourse to the seller of the receivables. Receivables buyers therefore weight the risk of the receivables seller higher than in the case of non-recourse purchase; with, however, a different emphasis than, for example, when granting a working capital credit facility. This is because, in contrast to a loan agreement where the borrower owes repayment plus interest on the loan, the buyer of receivables only demands repayment of the purchase price of the receivable if the original debtor of the receivable fails to make payment. This is referred to as a secondary credit risk. Further details can be found in the separate articles on factoring, forfaiting and receivables discounting.

From a legal point of view, the above three instruments are sale contracts. The situation is different with a dynamic discounting programme established by a buyer (debtor). Here, suppliers are given the opportunity to request early payment from the buyer. This is a request to amend the supply contract with regard to the due date of payment. The buyer accepts this early payment request by paying the invoice amount early, deducting a dynamic discount.

Indirect sources of liquidity aim at avoiding liquidity outflows due to payment defaults. In the case of guarantees/warranties and credit insurance, third parties (usually banks and insurance companies) make payment to the beneficiary or insured party if certain obligations (e.g. payment of the purchase price) are not met by the contractual partner. In the case of guarantees, guarantors usually pay the full amount of the guarantee on first demand. Credit insurers, on the other hand, only pay after a longer review process has been completed and usually with a discount on the default amount.

Documentary collections and letters of credit are payment instruments. With documentary collections, it is ensured that the buyer only receives the goods/services if he/she makes payment or accepts a deferred payment term. With a documentary collection, the acceptance risk for the goods/services remains with the supplier. A letter of credit ensures that banks make payment of the amount specified in the letter of credit upon presentation of documents specified in the letter of credit in accordance with the terms of the letter of credit (e.g. shipment of the goods within a certain period). The risk of acceptance existing under a documentary collection is thus avoided.

Further information on this can be found here: What is Trade Finance?